Brexit and your eBay business

Last updated: 27 July 2022

Overview

With the UK leaving the European Union, there are now additional rules and regulations affecting users who sell, purchase or move items between the UK and the European Union. New rules also exist for items moving between Great Britain and Northern Ireland. For more detail on these rules, please visit the UK Government’s Brexit checker.

Exports to the European Union will also now be subject to import VAT at the destination EU country. Low value consignment relief thresholds will still apply until 1 July 2021 to items shipped from the UK to European Union countries.

It is important all sellers have understood all the implications of the new rules on VAT, duties, and import and export regulations that are specific to their business. Please consult your tax and legal advisor for further information.

Sellers from GB (England, Wales & Scotland) delivering to an EU address

When you sell into the EU, whether as a business or private seller, your items will be subject to import VAT at the destination EU country and this import VAT, import duties or any other duties will be payable by the buyer.

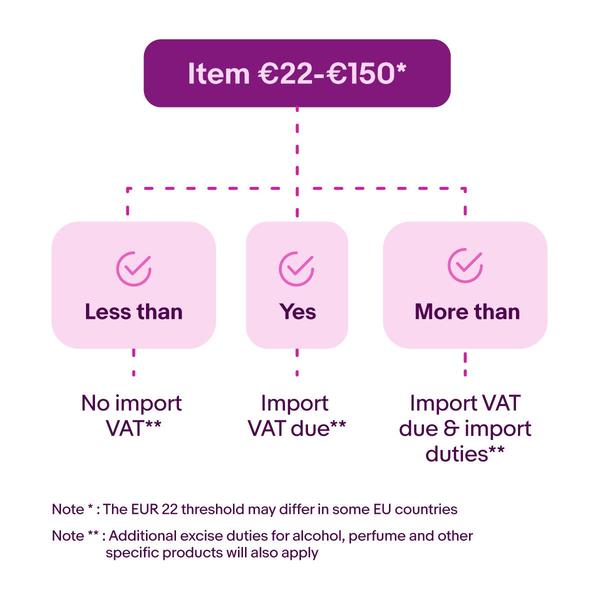

The exact import VAT threshold and duty treatment may vary depending on the country or items involved. We have set out some general information to the left.

Options for Sellers when sending to the EU

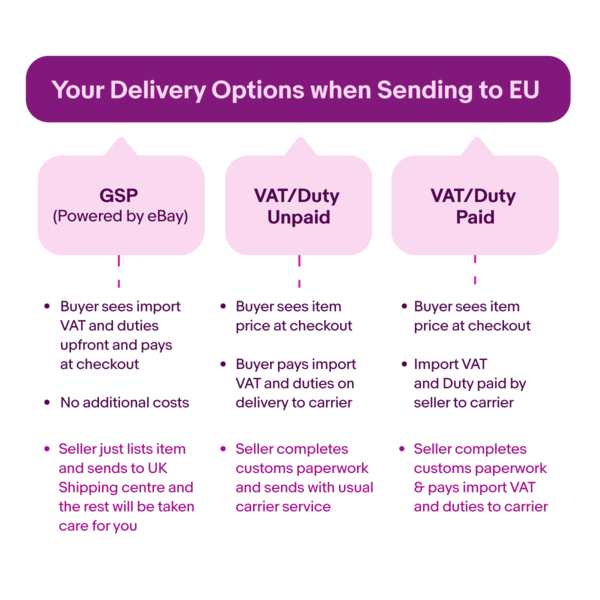

- Global Shipping Programme (GSP) makes international selling as simple as domestic delivery. You don’t have to pay anything extra – just the cost of posting to the UK Shipping Centre, and the rest (tax/duty calculation/customs clearance/international delivery) will be taken care of. Also, when you use GSP your seller performance standards are protected, for example from delivery delays/Item not received. For more information on how Global Shipping Programme (GSP) can facilitate your exports please click here.

- Check with your carrier the availability of their duty-paid solutions to ensure seamless buyer experience.

Additional points to consider

In addition, in accordance with government guidance business sellers are likely to be asked to provide the following information to their carrier when moving items out of Great Britain:

- EORI number to move items to the EU. Further information can be found at: https://www.gov.uk/eori

- Customs declarations that include Commercial Invoice/Country of Origin/Seller VAT number, if applicable. Please contact your carrier for more guidance.

UK Trader Scheme

Traders are also urged to consider whether they need to sign up to the new UK Trader Scheme (UKTS) to ensure traders don’t pay tariffs on the movement of goods into Northern Ireland from Great Britain where those goods can be shown to remain the UK’s customs territory from 1 January 2021.

Businesses can apply for a UKTS authorisation, allowing them to self-declare goods not “at risk” of moving on to the EU after entering Northern Ireland. This means they will not be subject to EU duties on goods being sold to or used by consumers after entering Northern Ireland from Great Britain, regardless of the outcome of the UK-EU FTA negotiations. Businesses who do not sign up could have to pay tariffs on their goods, unless they are eligible to claim a waiver.

Registering for UKTS is a simple and straight-forward process. Businesses can do this online at GOV.UK. The scheme is open to traders of all sizes and across all industries who operate under the Northern Ireland Protocol (NIP).

Estimated Delivery Day(s)

Useful Guides about placing manufactured goods on Great Britain and EU markets

- New product markings and conformity assessment – This guide answers questions on two product marking requirements for businesses placing goods on the UK market.

- UKCA marking step by step guide - The UKCA marking is the new product marking which demonstrates that certain goods are compliant with UK regulations and is used when these goods are placed on the market in Great Britain. This guide tells you how to use the new UKCA marking in Great Britain step-by-step.

- UKNI marking step by step guide – The UKNI marking is a new conformity marking for products placed on the market in Northern Ireland (NI) which have undergone mandatory third party conformity assessment by a body based in the UK. This guide tells you how to use the new UKNI marking in Northern Ireland.

- UKCA & UKNI supply chain – This guide can help you get your business ready for the new UK goods regulatory regime.

- Placing manufactured goods on the EU market - This government website informs you on what you need to do to comply with regulations on manufactured goods you place on the EU market.

- CE marking – This government website informs you on how a product complies with EU safety, health and environmental requirements, and how to place a CE marking on your product.

Useful links

UK Government

The UK Government has released its Border Operating Model for the GB border from 1 January 2021 here.

Making customs declarations on EU imports after 1 January 2021 here.

Advice on accounting and paying any cross-border VAT in GB from 1 January here.

Policy paper on moving goods between GB and NI from 1 January here.

European Commission

Preparedness notices from the European Commission can be viewed here.