How to export

Unlock your inventory to global buyers across 190 countries

International trade, or cross-border trade (CBT), is a great way to scale your business and boost your sales. Before getting started, here’s a list of questions that will help you identify what options are right for you and your business:

-

Research

Which markets do you want to sell to?

-

Shipping

How do you want to ship your items?

-

Listing and Translation

How do you want to translate your listings? -

Taxes

Do you know how to manage taxes & customs?

When selling internationally there is a range of options from simple solutions to more advanced options. The guide below helps you work out which one is right for you.

Research

Which market do you want to start trading in? To identify opportunities for your business and to see how your inventory performs in other markets, we recommend you use Terapeak, our product research tool. Terapeak can be accessed by all sellers through Seller Hub and can support your research on international sites.

Selling internationally to Europe is different to selling internationally to the rest of the world. However many UK sellers choose European countries as a starting point due to the accessibility of the markets.

Please note:

From 1 July 2021, the EU implemented legislation which shifts the responsibility for collecting VAT for online purchases from sellers to marketplaces such as eBay in certain circumstances. Sellers need to be aware of the changes and how that impacts their international sales.

Learn more about your VAT obligations

Example:

| Consignment Value | EU Process | Rest of World (ROW) Process |

| < £135 | eBay collects VAT from buyer at the checkout |

Buyer pays Import VAT & Duties to the carrier |

| > £135 | Buyer pays Import VAT & Duties to the carrier |

Buyer pays Import VAT & Duties to the carrier |

Shipping

To sell internationally on eBay, you have three options:

- eBay’s Global Shipping Programme:

Add international shipment and use eBay’s GSP

- Basic international selling:

Add international shipment to your listings and use your own carrier - Advanced international selling:

List directly on international eBay sites and use your own carrier

Some examples of how to approach Cross-Border Trade (CBT)

The table below is not a comprehensive guide to CBT but contains some important points to consider:

| 1. GSP | 2. Basic international selling | 2. Basic international selling |

3. Advanced international selling | 3. Advanced international selling |

|

| Activate eBay’s Global Shipping Programme All values |

Add international shipment to your listings (Basic CBT) - Under €150 |

Add international shipment to your listings (Basic CBT) - Over €150 |

Sell directly on eBay international sites - Under €150 |

Sell directly on eBay international sites - Over €150 |

|

| Benefits | All customs, duties and tax calculations required will be automatically managed for you. |

You have control of your international shipping costs & delivery of your items. |

You have control of your international shipping costs & delivery of your items. |

You have control of your international shipping costs, delivery of your items and all item translations, giving you better visibility of your transactions and potentially higher sales. |

You have control of your international shipping costs, delivery of your items and all item translations, giving you better visibility of your transactions and potentially higher sales. |

| Tax/Duties calculations |

Included | Included | Excluded | Included | Excluded |

| Delivery/Carrier | Included | Managed by seller | Managed by seller | Managed by seller |

Managed by seller |

| Customs | Included | Use IOSS to clear | Clear as DDU or use DDP | Use IOSS to clear |

Clear as DDU or use DDP |

| Translation | Title (by eBay) | Title (by eBay) |

Title (by eBay) |

Full (by sellers) | Full (by sellers) |

| Customer Service | eBay handles shipping-related questions | Managed by seller | Managed by seller |

Managed by seller |

Managed by seller |

| Returns | Managed by seller |

Managed by seller |

Managed by seller |

Managed by seller |

Managed by seller |

IOSS = Import One-Stop Shop

DDU = Delivery duty unpaid

DDP = Delivery duty paid

Once you have assessed and chosen the right option for you as a seller, you can then get your listings set up to sell internationally.

Listing & Translation

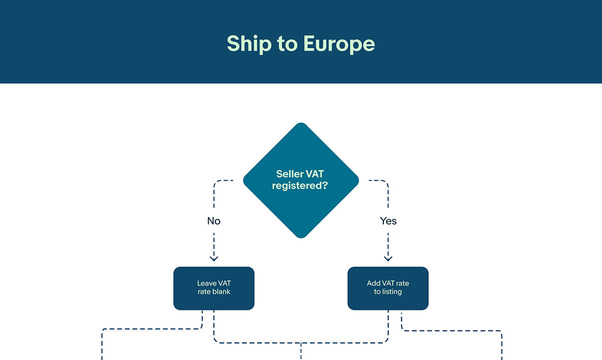

Click on the link below to see the full flowchart of the listing process when you sell to Europe:

You can use the following options to translate your listings

Taxes

Some helpful links on taxes and duties when selling to to the EU:

Your delivery options

Delivery options when sending to the EU and how taxes and duties are paid.

Tax services

We’ve teamed up with specialised tax services (Avalara, eClear & Taxdoo) and created three packages (Light, Full and Extra) for which eBay sellers get exclusive discounts. These packages aim to simplify the facilitation of sellers VAT obligations, VAT reporting, and offer individualised support.

Find out more about the packages they offer:

eBay & Brexit

With the UK leaving the European Union, there are now additional rules and regulations affecting users who sell, purchase or move items between the UK and the European Union.

EU VAT

From 1 July 2021, new changes to the VAT treatment of imports into the EU, as well as certain shipments within the EU, have come into effect.